Double declining method formula

The Double Declining Balance Depreciation Method Formula. To consistently calculate the DDB depreciation balance you need to only follow a few steps.

Double Declining Balance Depreciation Method Youtube

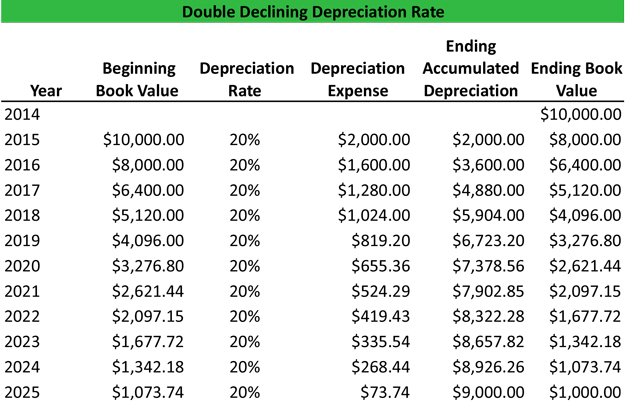

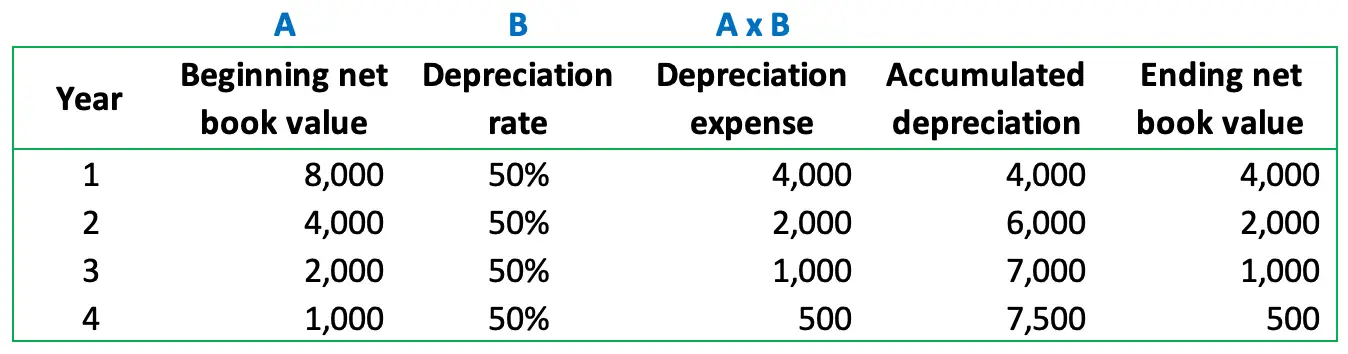

While the total expense remains the same over the life.

. Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore. MIN cost - pd factor life cost - salvage - pd where pd total depreciation in all prior periods. 2 x basic depreciation rate x book value.

The double-declining balance method uses the following formula to calculate depreciation. The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2. This article describes the formula syntax and usage of the DDB function in Microsoft Excel.

DDB 2 x straight-line. To calculate depreciation the DDB function uses the following formula. 50 000 x 40.

They can use the following double-declining balance method formula to calculate the depreciation charge. In other words the depreciation rate in the double-declining balance depreciation method equals the straight-line rate multiplying by two. To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life.

Now that you have all of the information you can follow the formula for double declining balance depreciation. The double declining balance formula. First Divide 100 by the number of.

Depreciation Opening book value of the fixed asset x Straight-line depreciation. Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM. Depreciation 2 x straight-line depreciation rate x book value The straight-line.

Double declining balance is calculated using this formula. Returns the depreciation of an asset for a specified period using the double. In this case the book value is 20000.

The formula for depreciation under the double-declining method is as follows. The double declining balance is.

Double Declining Balance Method Prepnuggets

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Ddb Method Of Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Calculator

What Is The Double Declining Balance Method Definition Meaning Example

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Daily Business

Simple Tutorial Double Declining Balance Method Youtube

Calculate Double Declining Balance Depreciation Accountinginside

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Depreciation Formula Examples With Excel Template

How To Use The Excel Ddb Function Exceljet